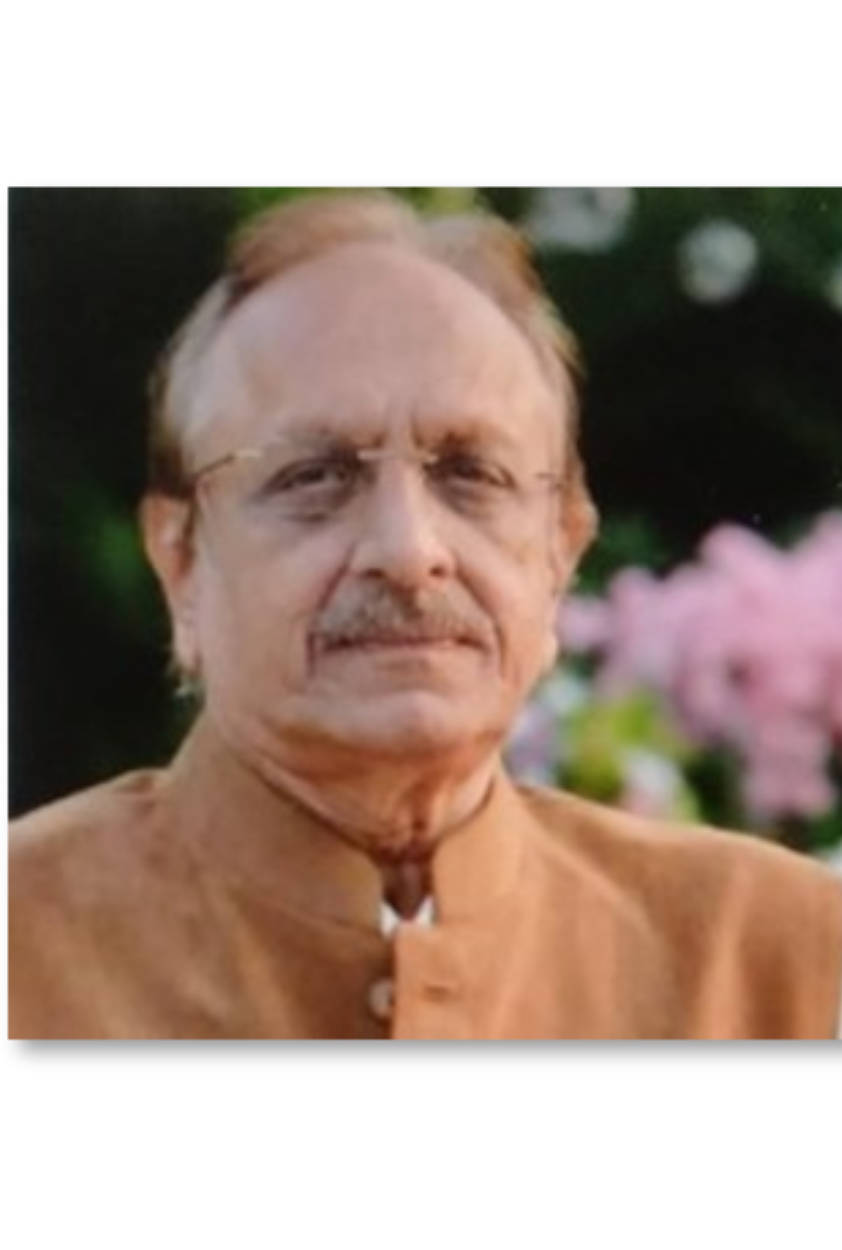

Shri . Sushilkumar Agrawal

Mentor & DirectorHe is Chartered Accountant by profession having 47 years practice. Also he is Chairman, Director, Member of numerous Companies and Trust with a hands-on experience of overall management of company. All these institutions expanded in a big way under his guidance.